Dalam dunia perjudian seperti togel, mencari keuntungan adalah hal yang banyak diinginkan oleh para pemain. Salah satu platform yang populer adalah Warga88, yang menawarkan kesempatan untuk bermain togel Hongkong, Singapore, dan Sydney secara online. Dalam artikel ini, kami akan membahas rahasia dan strategi terkini untuk bermain togel di Warga88, beserta link, cara daftar, dan login ke platform ini.

Sebagai pemain togel, memiliki akses ke informasi terkini dan strategi yang efektif sangat penting. Warga88 menawarkan layanan togel yang dapat diakses dengan mudah, baik melalui komputer ataupun ponsel. Dengan menggunakan link resmi dari Warga88, Anda dapat menikmati pengalaman bermain togel yang menyenangkan dan menguntungkan.

Untuk mulai bermain togel di Warga88, langkah pertama yang perlu dilakukan adalah melakukan pendaftaran. Caranya cukup mudah, Anda hanya perlu mengisi formulir pendaftaran dengan informasi yang diperlukan dan mengikuti petunjuk yang ada. Setelah mendaftar, Anda akan mendapatkan akun yang dapat digunakan untuk login ke platform Warga88 dan menikmati berbagai permainan togel yang tersedia.

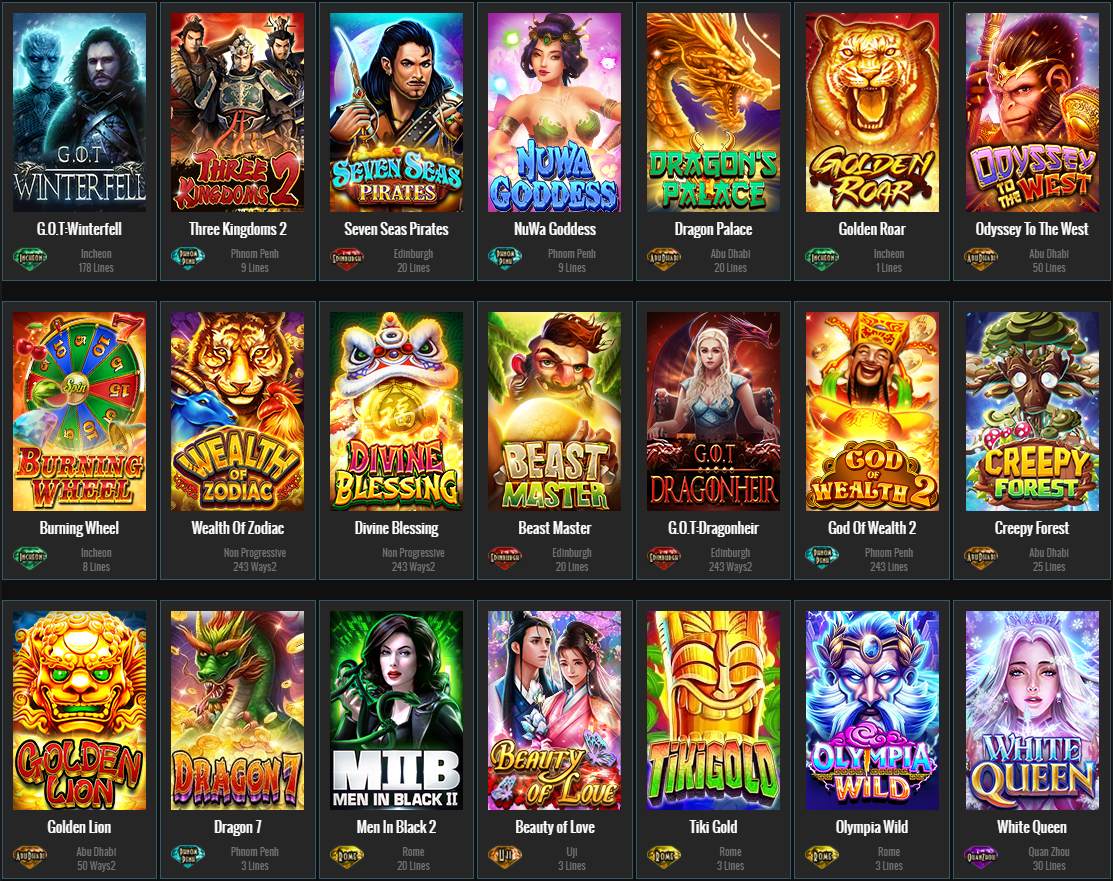

Dengan menggunakan Warga88 sebagai platform Anda, Anda memiliki kesempatan untuk bermain togel di Hongkong, Singapore, dan Sydney. Platform ini juga menyediakan berbagai strategi terkini yang dapat membantu meningkatkan peluang Anda dalam meraih kemenangan. Dengan mengikuti strategi yang disarankan dan menggunakan informasi aktual yang diberikan, Anda bisa menjadi lebih percaya diri dan cerdas dalam memilih angka-angka yang ingin Anda pasang.

Jadi, jika Anda tertarik untuk bermain togel dan ingin mencoba keberuntungan Anda, Warga88 adalah pilihan yang tepat. Dengan akses mudah melalui link resmi, proses daftar yang sederhana, dan strategi terkini yang ditawarkan, Anda dapat merasakan sensasi dan keuntungan dari bermain togel secara online. Mulailah petualangan taruhan Anda di Warga88 sekarang juga!

Link, Daftar, dan Login ke Warga88

Pertama-tama, mari kita bahas tentang link Warga88. Bagi Anda yang ingin bermain togel Hongkong, Singapore, atau Sydney melalui Warga88, Anda dapat mengakses link resmi mereka di www.warga88.com. Link ini akan membawa Anda langsung ke situs resmi Warga88 yang menyediakan layanan taruhan togel online.

Selanjutnya, untuk bisa bermain di Warga88, Anda perlu melakukan daftar akun terlebih dahulu. Proses pendaftarannya sangat mudah. Anda hanya perlu mengisi formulir pendaftaran dengan informasi yang valid, seperti nama lengkap, alamat email, nomor telepon, dan kata sandi yang aman. Setelah mengisi formulir tersebut, Anda akan mendapatkan akun bermain di Warga88 untuk mulai bermain togel.

Setelah berhasil mendaftar, langkah selanjutnya adalah login ke akun Warga88 Anda. Silakan kunjungi halaman login di www.warga88.com dan masukkan informasi login yang Anda daftarkan saat mendaftar tadi, yaitu alamat email dan kata sandi. Setelah berhasil login, Anda akan dapat mengakses semua permainan togel yang disediakan oleh Warga88.

Ini adalah beberapa informasi mengenai link, daftar, dan login ke Warga88. https://www.justmedsrx.com/ sukses!

Togel Hongkong, Singapore, dan Sydney di Warga88

Berkat Warga88, Anda dapat menikmati permainan togel dari Hongkong, Singapore, dan Sydney dengan mudah dan praktis. Warga88 menyediakan akses yang aman dan terpercaya untuk bermain togel, sehingga Anda tidak perlu khawatir tentang keamanan data pribadi Anda. Dengan menggunakan link Warga88, Anda dapat mengakses permainan togel favorit Anda kapan saja dan di mana saja.

Untuk memulai, Anda perlu melakukan pendaftaran di Warga88. Proses pendaftaran ini sangatlah mudah dan cepat. Anda hanya perlu mengisi formulir pendaftaran yang disediakan dengan informasi yang valid. Setelah itu, Anda akan mendapatkan akun untuk login ke platform Warga88 dan memulai permainan togel.

Setelah berhasil mendaftar dan login, langkah selanjutnya adalah memilih jenis permainan togel yang ingin Anda mainkan. Warga88 menyediakan opsi permainan togel dari Hongkong, Singapore, dan Sydney. Anda dapat memilih dari ketiga jenis togel ini sesuai dengan preferensi Anda.

Nikmati pengalaman bermain togel yang seru dan menegangkan di Warga88. Dengan link Warga88, proses pendaftaran dan login yang mudah, serta pilihan permainan togel dari Hongkong, Singapore, dan Sydney, Anda tidak perlu mencari platform lain untuk bermain togel. Segera daftar dan login ke Warga88 sekarang juga!

Rahasia dan Strategi Togel Terkini

Pada artikel ini, kami akan membahas beberapa rahasia dan strategi terkini dalam permainan togel. Dalam bermain togel, terutama togel Hongkong, togel Singapore, dan togel Sydney, banyak faktor yang perlu diperhatikan agar dapat meningkatkan peluang kemenangan.

Salah satu faktor penting adalah memilih situs yang tepat untuk bermain togel. Salah satu situs yang populer adalah Warga88. Dengan link Warga88 yang tersedia, Anda dapat dengan mudah mengakses situs ini untuk memasang taruhan Anda. Pastikan Anda mendaftar dan melakukan login ke akun Anda di Warga88 untuk memulai permainan togel dengan lancar.

Selain itu, strategi yang tepat juga dapat membantu Anda memperoleh hasil yang diinginkan dalam togel. Penting untuk melakukan analisis dan riset terkait angka-angka yang sering muncul dalam togel Hongkong, togel Singapore, dan togel Sydney. Dengan memahami pola-pola yang ada, Anda dapat membuat prediksi yang lebih akurat. Selain itu, jangan lupakan faktor keberuntungan yang juga turut berperan dalam permainan ini.

Dalam bermain togel, kesabaran juga merupakan kunci keberhasilan. Jangan terburu-buru dan jangan bermain terlalu banyak taruhan secara serentak. Jaga emosi Anda dan tetap tenang saat bermain. Dengan menjaga kondisi pikiran yang baik, Anda dapat membuat keputusan yang lebih tepat dalam memasang taruhan.

Demikianlah beberapa rahasia dan strategi terkini dalam permainan togel, terutama togel Hongkong, togel Singapore, dan togel Sydney. Ingatlah bahwa togel adalah permainan yang mengandalkan keberuntungan, namun dengan mengikuti strategi yang tepat dan menjaga kesabaran, Anda dapat meningkatkan peluang kemenangan Anda. Selamat bermain togel dan semoga sukses!